I can’t afford it.

You hear this from mothers or fathers telling their kids who wanted a new toy from the store.

You hear this from tight budgeted moms telling their selves as they look at a lipstick they’ve been eyeing for two months now.

You hear this from people to insurance/financial advisors when they’re presented a long term investment solution.

You hear this everywhere. We wait for a big break to finally afford an unthinkable dream. We wait for a raise, however when it kicks in our pay slip, we find out it’s still not enough, we wait another year until waiting becomes forever.

Let me show you ways on how I was able to remove the ‘T from the sentence on top:

- Downgrade and Upgrade

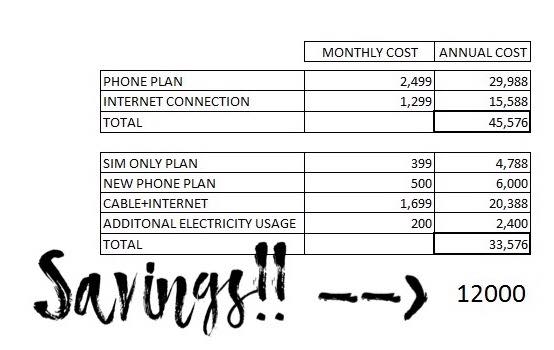

When I reached my first year in the company where I’m at right now, I decided to go for a phone plan for P2500 a month. I had it for 4 years. On the third year, however, they no longer offer the same plan inclusions. I decided to downgrade to a Sim Only Plan which costs P399 a month, then applied for another phone line from their competitor for P500 a month, with a non-top of the line phone, but offers a significant number of calls, sms, and a limited number of data. For 899 a month, I now have an extra P1600 I can allot somewhere else. We’ve upgraded our cable and internet connection to P300 higher than gives multiple tv channels (we can now watch the replay episodes of Game Of Thrones in HBO HD) and unlimited, high speed data. Although, since we added cable, we saw an increase to our electricity consumption, which was P200/month.

All in, for downgrading my phone line and upgrading our cable and internet connection, I’m still saving P1000 a month.

- Pay in Cash.

I love paying two ways, credit card via 0% installment options, and cash, in full. If you will look at your children’s tuition fee, if you decide to pay it monthly, the total amount you eat to pay in total is sometimes higher than what you are to pay when you pay it in full. Also, be on a lookout for Early Bird Promos, that sometimes give a small discount if you pay it before a specified time. It may be as small as P1000 a year but hey, you won’t get the chance to pick up a thousand-peso bill while on your way to work, right?

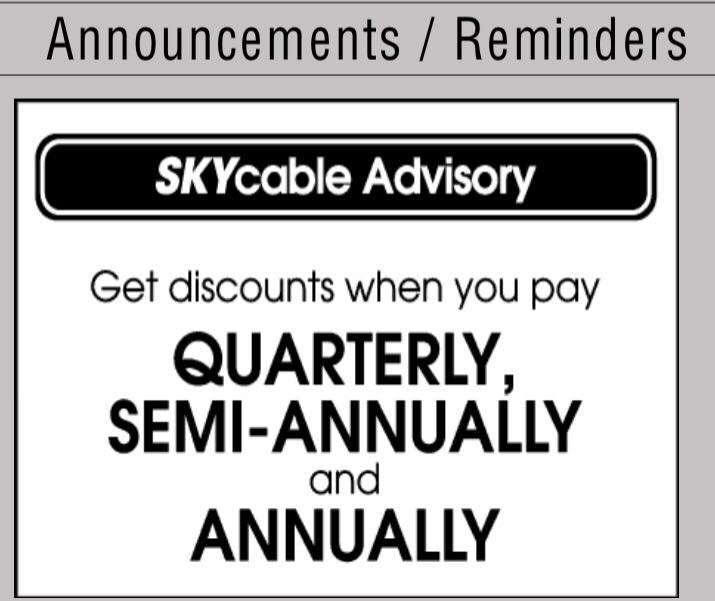

- Pay cable subscriptions and insurance premiums annually.

I love reading bills even if they get to be automatically charged to me each month. I get to see any promos they may have in store for me. Recently I found out that my cable company gives a month discount if you pay your subscription annually. After crunching numbers, I’m able to know when can I start signing up for it, giving me another 1599 increase. For our insurances, we started paying semi-annual this year, but looking at being able to pay annually next year. Insurance payments may offer monthly installments but if you multiply that to its annual cost, you get to pay an extra amount for the convenience of paying it every month. That’s almost a total of P7000 a year we didn’t have to pay just because we decided to pay it in lumpsum.

- Find alternatives

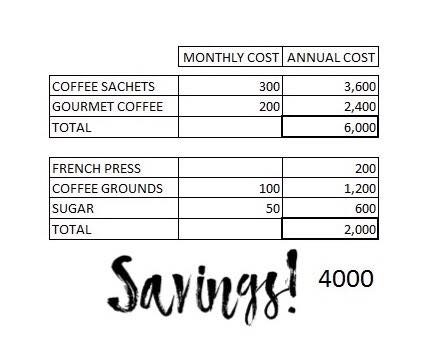

I’m a huge coffee drinker. I cannot start a day without coffee. I used to be a fan of 3in1 coffees and seldom go to well-known coffee shops but still would still bring me a conservative monthly expense of P500.

Just last year, I was introduced to coffee beans, you get to have one fourth of a kilo for less than a hundred. I’m fortunate to be in touch with someone who regularly goes to Baguio and when she’s back in Manila, she brings me half a kilo of freshly ground coffee. This is a stash good for a month and a half.

I was also able to find a cheap coffee press for less than two hundred. Calculating my expense for pressing the coffee myself, I get to pay P2000 on the first year, and P1800 on the second year, if I decide my French Press doesn’t need to be replaced, just yet.

I was also able to find a cheap coffee press for less than two hundred. Calculating my expense for pressing the coffee myself, I get to pay P2000 on the first year, and P1800 on the second year, if I decide my French Press doesn’t need to be replaced, just yet.

Annually, I get to save P4000 a year!

Where to Put the money I saved?

Perhaps you feel the amount you place on your allowance isn’t keeping up to your needs, which is why you haven’t bought that red lipstick you’ve been eyeing a long time now, or you have been saying no to your kids quite some time now, or always waiting for the right time to invest on an insurance. best to keep the monthly savings into jars first. I love placing them in money jars because they’re not yet enough to pay for an initial deposit to place in banks, but if you put a goal in your money jar, saving for it becomes easier. You can’t afford buying a lipstick now, if you put 100 per payday to it, you’re able to afford it 4 months from now. If you’re aiming to buy your child a toy and you decide to put 300 per month to a jar for it, you’re able to save P1500 in 5 months. You can also place it to your emergency funds to speed up saving for at 3 to 6 months of your expenses. Soon, with discipline you’ll be able to afford more, invest more, all by starting to make things work.

How do you plan on increasing your income without asking for a raise? Let me know!